Global payroll guide

What is global payroll?

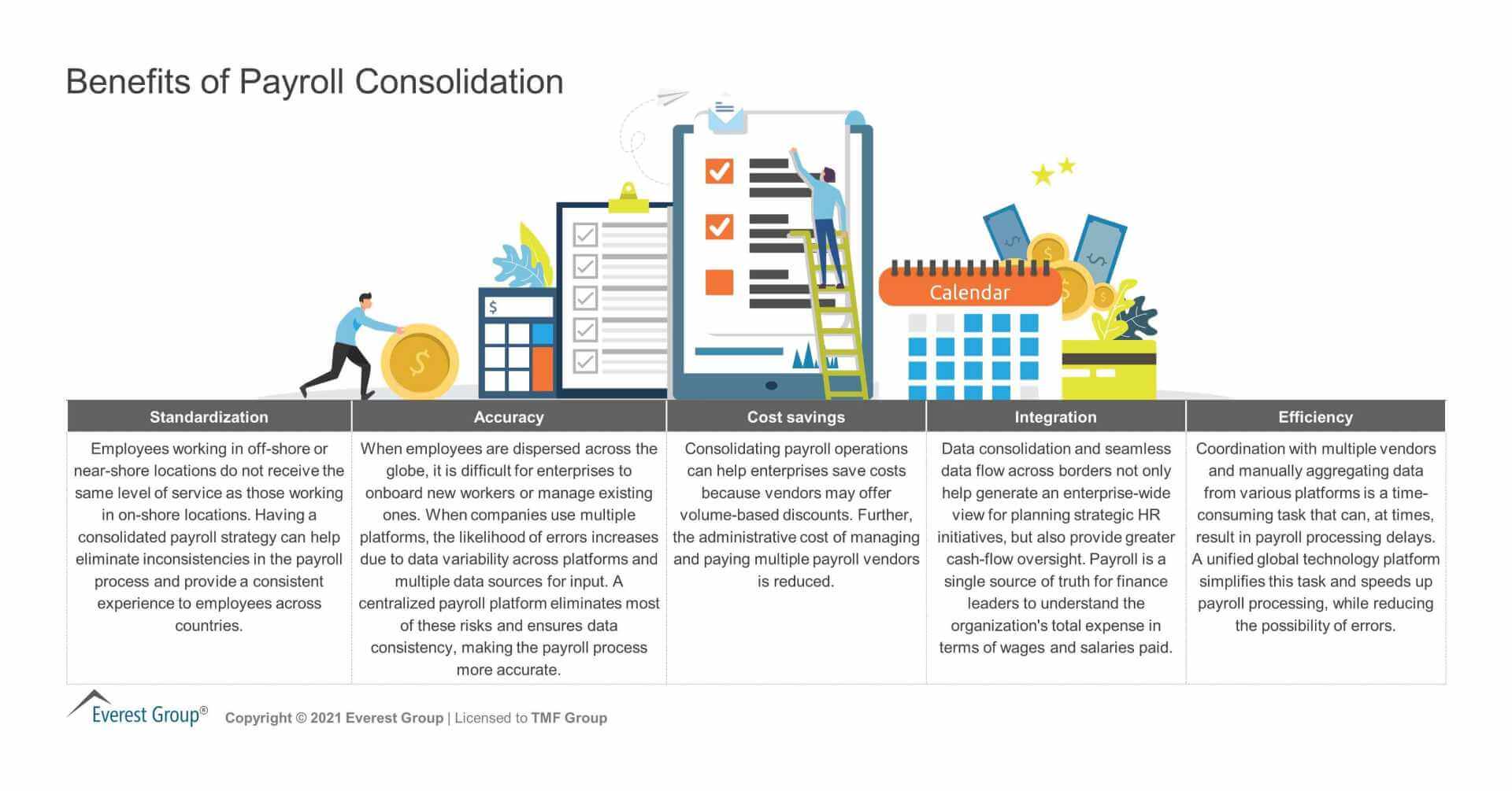

In simple terms, global payroll is the consolidated management of all of an organisation’s payroll needs, across every country in which it has employees. The benefits of having a consolidated global payroll include improved visibility, control, consistency, compliance and accountability, along with greater efficiency.

Source: paper ‘Multi-country Payroll (MCP) Consolidation Demystified. Key Considerations for an Employee-Centric Payroll’ by Everest Group.

The concept of global payroll sounds simple enough. After all, most multinational organisations have already consolidated other key business functions globally, including accounting, IT and human resources (HR).

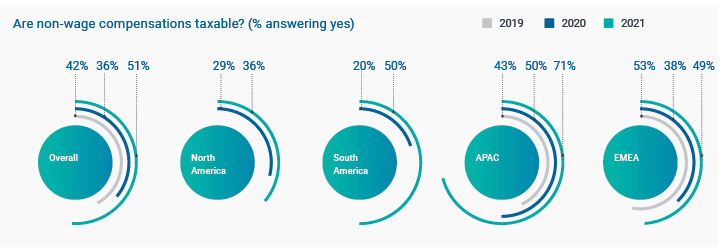

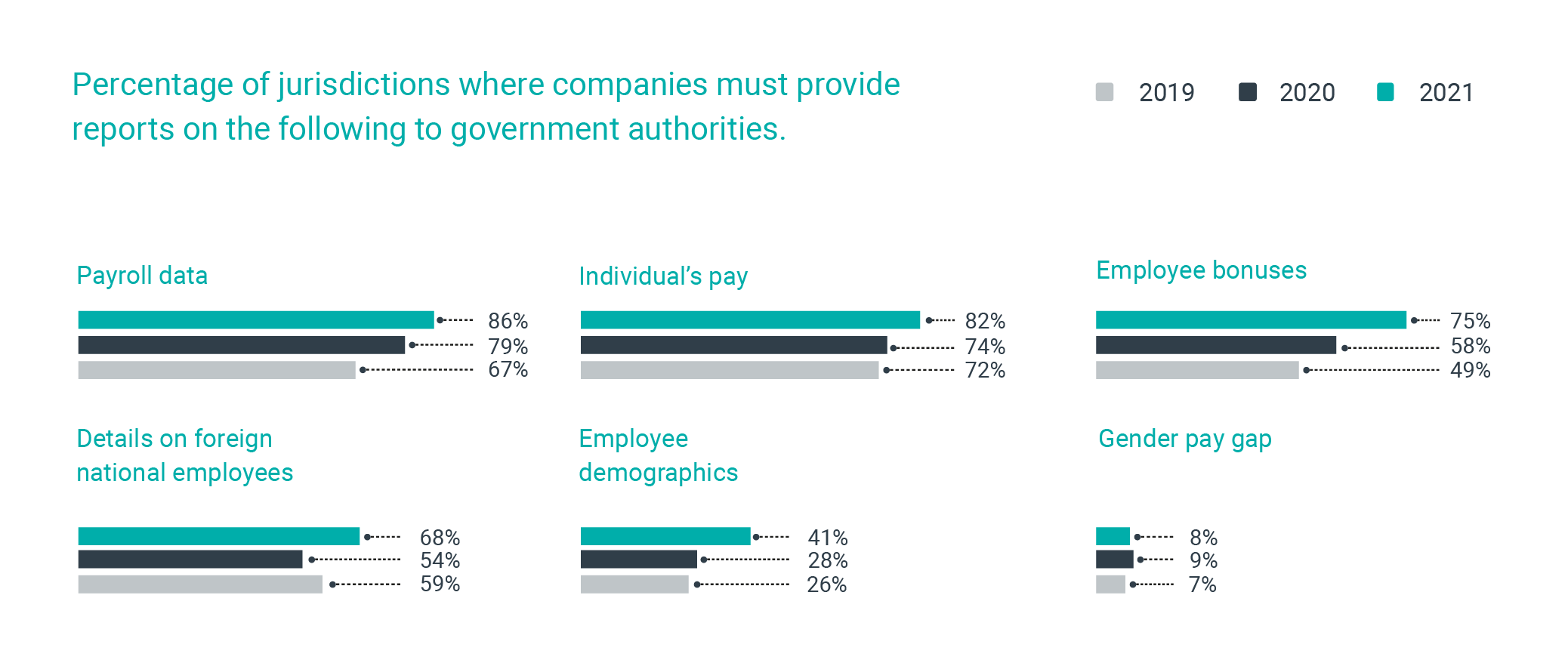

But having a consolidated global payroll is more complex. Employment and tax rules, regulations and practices are highly specific to each jurisdiction, and also change regularly. This was particularly evident during the pandemic when legislation was changing every month in some countries, creating significant challenges for global organisations that often struggled to ensure compliance.

Payroll is, by its nature, unique to every company and employee situation, and often involves a lot more human interaction than other business processes. It requires regular dealings with in-country tax offices, regulators, auditors and financial institutions – with all the specific language, procedural, cultural and technical nuances that entails. This complexity not only varies between regions, but also between countries in the same region – sometimes significantly.

Source: Global Business Complexity Index 2021 by TMF Group

Furthermore, from a technology perspective, there is no single platform or delivery model that can deliver global payroll, unlike for other business functions such as accounting and HR.

These complexities have driven the development of a number of different delivery models, which multinational organisations need to consider when deciding on the best way to handle their global payroll needs. These range from handling payroll fully in-house, often using Software as a Service (SaaS) solutions, through hybrid in-house/outsourced models, to a fully outsourced service.

Outsourcing can be done either through an aggregate model (main contractor plus third-party local providers), or through a single global provider that takes on all aspects of payroll delivery in all countries.

How organisations deliver global payroll is the result of a number of factors which best serve its objectives, while conforming to best practice within the region or country. Whichever model is chosen, payroll vendors will need to offer their clients a flexible solution, capable of evolving to satisfy the requirements for payroll accuracy, compliance, efficiency and accountability.

A recent paper from Everest Group analysts provides deeper insights into the challenges, benefits, and key considerations of multi-country payroll consolidation.

Should you consolidate your global payroll operations?

There is a conundrum at the heart of the desire to consolidate global payroll operations. On one hand, organisations want to benefit from the improved efficiency, better business insights and detailed, accurate reporting that a global payroll solution provides. On the other hand, they need the local knowledge and understanding of in-country compliance, cultural and language needs.

A clear example is Latin America where payroll is, perhaps, one of the biggest single issues facing foreign businesses. Not only must payroll managers navigate their way through the layers of complexity and inherent bureaucracy to get to grips with strict labour laws and tax rules, they also need to differentiate between a statutory requirement and a commonly accepted practice, which may be quite different.

Source: Global Business Complexity Index 2021 by TMF Group.

The big challenge is how to deal with smaller markets, where there may only be a handful of employees on the payroll in a specific country. Not only do smaller markets present challenges in terms of resource limitations, but the cost of any global payroll initiative has to be weighed against the relatively small number of employees being paid.

In many ways, running a payroll for five employees is no different to running it for 500 people. There are some common factors, including the need to gather data, make calculations and meet employment law and corporate reporting obligations, but this is where the similarities end.

The difficulty in dealing with payroll among a smaller employee population is a challenge in global payroll projects, and is perhaps the main factor in deciding which global payroll delivery model to use.

Ideally, organisations should be able to implement a flexible payroll solution that combines both the benefits of global consolidation and local expertise.

What payroll model suits you best?

As mentioned earlier, there are a number of possible approaches to setting up a global payroll solution:

Fully inhouse – this approach offers the benefits of high levels of control, visibility, accountability and security. The big downside is that having dedicated inhouse payroll resources is only really feasible in larger locations, such as headquarters, regional offices and service centres. Offices in smaller markets are unlikely to have the budget to employ dedicated payroll experts with the required knowledge and skills to handle payroll effectively. Employees in such locations need to be served by the payroll teams in other countries, who may not have the local regulatory knowledge, or even language skills, to deal with them effectively. In some instances, even with this model there is another potential hybrid solution – ‘processing’ – where some of the functions are outsourced to a payroll vendor. These might include calculation of the gross-to-net, and production of the payroll outputs, such as reports, payslips and bank files.

Hybrid inhouse/outsourced – to get around the challenge of using the fully inhouse approach, some organisations employ inhouse payroll resources in larger markets and outsource payroll to partners to cover smaller markets regionally or locally. This provides a flexible and relatively cost effective way to access local payroll expertise and knowledge in smaller markets.

Managed service – aggregator outsourced – this model partially deals with external provider management challenge by handing global responsibility for payroll to a main contractor, which manages third-party providers in smaller markets where it does not have coverage. Again, this can lead to poor visibility and blurred lines of responsibility, with third-party providers potentially playing the ‘blame game’ when things go wrong.

Managed service – partner – in this model, favoured by TMF Group, a single payroll outsourcing provider takes on complete responsibility for global payroll delivery in every country the organisation operates in. This allows for a single point of contact for the organisation to go to when there are changes to be made or issues to address, and lines of responsibility are very clear.

The option to add services that go beyond payroll is also a crucial consideration when identifying a suitable model. For example, TMF Group offers a suite of complimentary services - ranging from both HR and benefits administration to consultancy services - along with a planned developmental roadmap that allows for the addition of further components later down the line.

A full scope of HR services will enable an organisation to effectively manage the significant investment made in human capital, safe in the knowledge that their vendor meets all their requirements - from both short and long-term perspectives.

What is the role of technology when managing global payroll?

One of the biggest benefits of global payroll consolidation is the consistency and control resulting from robust global or multi-jurisdictional payroll policies and processes, instead of managing each market on an individual local basis. This reduces errors in payroll processing and minimises the risk of non-compliance for organisations operating in multiple jurisdictions.

It requires appropriate technology to support payroll operations on a global scale. Given the wide variety of payroll platforms around the globe, there is a growing trend towards adopting middleware to provide a consolidated view of payroll processing status and unified payroll reporting across all operating markets.

This global business middleware sits as a layer over the top of multiple payroll systems and is able to pull all of the necessary reporting data together in a more accurate, secure and timely manner. It also enables payroll professionals to drill down into information held in systems around the world, making it easier to spot problems and see trends.

While online technology platforms are vital to providing global payroll reporting and analytics, it is essential to complement this with the right people at global, regional and local levels to ensure payroll is delivered in an accurate, timely and compliant way. Knowledge of in-country legislation and requirements, together with the ability to communicate in the local language are key.

The most common reason for organisations to outsource their global payroll services to partners like TMF Group is to gain access to local experts and their knowledge, both in language terms and in relation to local legislation.

How to manage payroll during carve-outs, mergers and acquisitions?

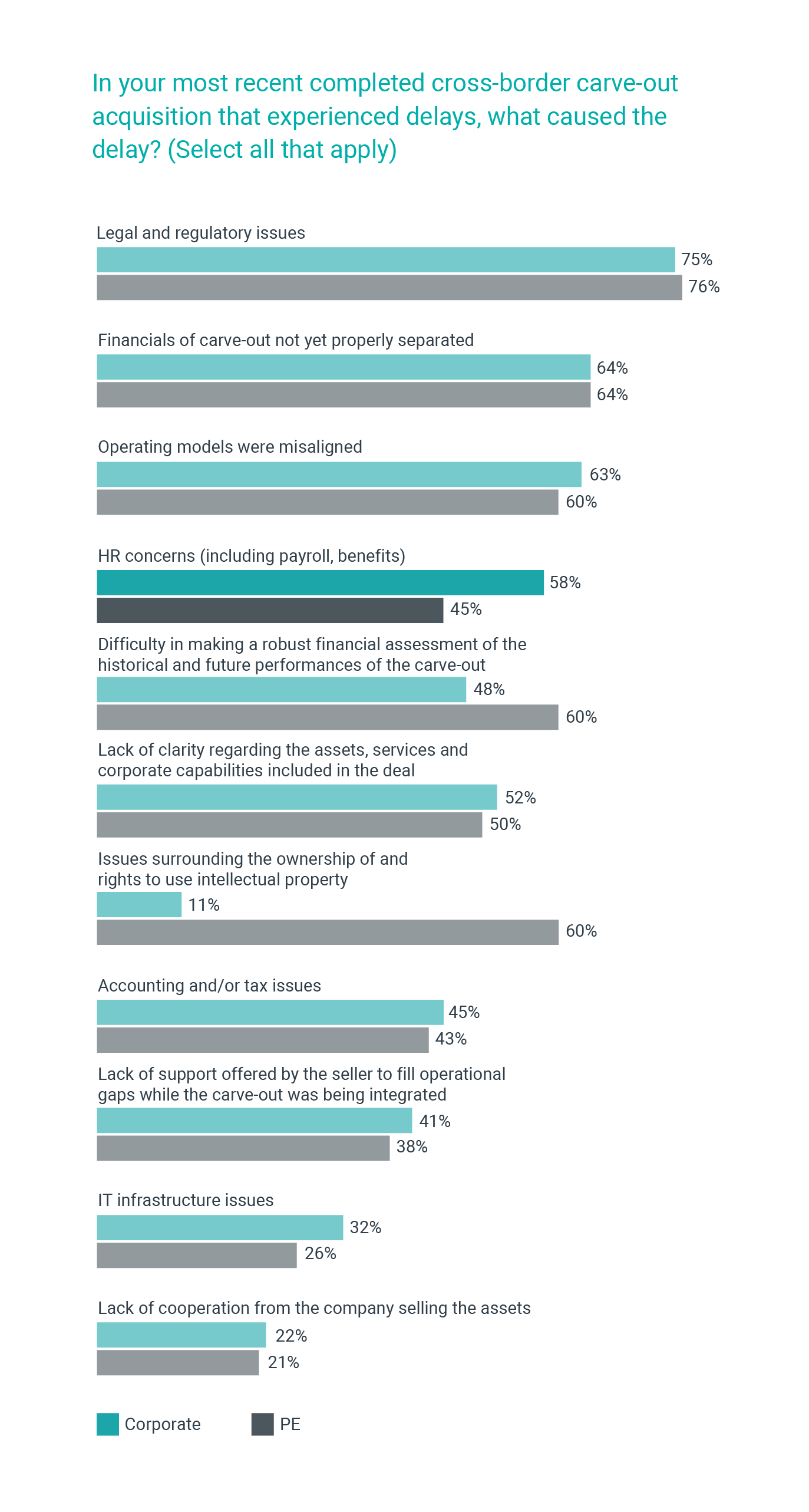

Payroll plays a major role in helping manage the execution of carve-outs, mergers and acquisitions (M&A). However, the issues faced by payroll are not always understood elsewhere in the organisation, particularly in international deals.

Bringing together organisations that use different software, schedules and pay policies is complex, and not getting it right can lead to serious compliance issues. Benefits packages must be commensurate, while late payment irritates employees, damages corporate reputations and can result in fines.

The drivers of M&A vary widely, from long-planned takeovers designed to propel companies into new markets and geographies, through opportunistic deals that take advantage of short-term market conditions, to tactical deals that bring in products, technologies or expertise. As a result, the requirements that fall on payroll will also vary from deal to deal – requiring it to react, often at short notice, in different ways to different situations.

One problem the payroll team faces, however, is that it’s typically a junior partner in the M&A cycle, with information often passed on late and decisions made without assessing the impact on payroll operations. Payroll is never going to be at the forefront of what are highly sensitive and often tightly regulated M&A procedures – but as a downstream partner, the impact of decisions made in the M&A cycle can be severe.

Source: Paper ‘Cross-border carve-outs. Why one third fail and how to get them right’, from TMF Group

It’s vital to consider payroll as early as possible when managing mergers and acquisitions.

Does payroll have an impact on the employee experience?

It is critical that employees have a positive experience as they interact with payroll providers and systems. Consolidating payroll activity into one secure, interactive portal can improve efficiency, productivity and allow greater employee engagement in a consistent way.

As businesses expand and hire in new locations, the need for effective payroll delivery becomes ever more important. Payroll is not limited to simply providing employees with payslips and payments on time; it also involves sharing individual documents, making HR documentation available to keep employees up to date with the latest company policies, and managing day-to-day queries raised by employees about their pay and other entitlements.

One way organisations can serve these needs effectively – and enhance employee engagement through ease of access and greater visibility, while reducing the load on the payroll team – is through offering a single, secure global payroll portal. This portal should enable employees to:

- access their employment information anytime, anywhere, using a desktop, tablet or mobile device

- view, print, download and save payslips locally, without resorting to email

- access a centralised document library, where they can easily find and download things like employment contracts, corporate policies, or a travel and expenses document

- communicate directly with the HR or payroll department through a ticket system, rather than having to send numerous email enquiries to an individual or a shared inbox.

What are the potential pitfalls when implementing global payroll?

Consolidating global payroll has many benefits, but there are several obstacles to making it a success if the right resources are not on hand to help get it right. Here are some of the top pitfalls we see as organisations look to move from local to global payroll handling:

The risk of inertia – while efficiency is a key driver in selecting a payroll model, it is often very challenging for ‘historical’ practices (such as manual approvals handling), which can potentially limit the range and scope of global payroll delivery capability.

Missing local knowledge and experience – lack of knowledge about in-country legislation and other requirements is one of the biggest challenges, and risks, when implementing global payroll solutions. Having an in-country contact, able to communicate in the local language, is paramount.

Non-compliance and inconsistencies across borders – organisations implementing global payroll often have difficulty in finding information on local legislation and compliance, and then in achieving consistency in policies and processes across the global organisation. It is still quite common for organisations to lack any global or country payroll processes or policies, and instead manage each market individually and locally. This greatly increases the risk of non-compliance, which can lead to severe penalties, and even jail time in some jurisdictions. For example, companies that fall foul of the EU’s GDPR regulations can be fined up to four percent of their turnover.

Failing to get the global view – most organisations do not yet have the ability to view the payroll processing status across each of their operating markets, let alone have the ability to consolidate a single global payroll report for all their operations.

Getting global payroll wrong can have significant implications. For most organisations, getting global payroll right can seem like a daunting task. This is why many organisations are choosing to work with a global partner that also has the right local knowledge in each market. Such a partner can take on a lot of the heavy lifting, ensuring compliance with local rules and regulations right from the start, saving time and money, and enabling organisations to focus on the strategic big picture.

Is it essential to have a business continuity plan in place?

The pandemic has turned the spotlight on the importance of business basics, like payroll, and the need for resilience and flexibility in response to rapidly changing business conditions.

Most organisations have business continuity plans (BCP) in place, but they tend to be country-specific and related to specific events or incidents, such as cyber attacks. Now it’s about expanding those plans to include payroll and thinking about strategies where tasks can be shared by other offices.

That rethinking often results in a wholesale change in the way BCP is approached − for example, an office in Belgium supporting payroll processing in France. This burden-sharing is likely to continue as the pandemic recedes, with businesses looking to make their operations more streamlined to cope with further upheavals.

What do you need to have visibility of your global payroll operations?

The ability to monitor a global payroll operation is vital. It is important to have a solution that provides analytics to effectively report on payroll performance, to support better-informed business decisions and ensure greater control and consistency in global operations.

For example, it may be useful to see payroll costs in a single currency to aid global cost analysis. Or it may be desirable to be able to share reports with management located around the world in a single format.

A comprehensive service and technology solution is essential to providing a global payroll service that also supports accurate and timely global reporting, analytics, visibility and control of core data. Here are some criteria organisations should bear in mind when choosing or implementing a global payroll solution:

Process Status – visibility of payroll processing status at an individual level, across the globe, with easy access to data through a standard global reporting tool that eases everyday workloads. Look for comprehensive dashboards – charts, heat maps and metric statistics - that enable you to fully visualise your payroll results.

Accessibility – solution should allow management to access the right payroll information at the right time, and from anywhere in the world.

Consolidation – being able to consolidate payroll data from disparate systems into single format, global reports will help produce meaningful insights that can drive better informed business decisions.

Efficiency – a selection of standard reports, or the ability to download core data into your own data warehouse for internal reporting helps improve efficiency. It also reduces frustrations, enhances employee engagement and so provides an improved payroll service.

Control – key performance indicators are common in the payroll industry. But how visible are they in current operations? Ensure there is access to KPI monitoring dashboards to keep track of both supplier and own service deliverables.

Audit – should have a comprehensive audit facility and reporting tool, to give your auditors peace of mind.

If you are considering multi-country payroll outsourcing as one of the options for your company, you might want to check out our guide about payroll outsourcing.