GBCI 2022: The rise of ESG

The Global Business Complexity Index 2022 (GBCI) provides an authoritative overview of the complexity of establishing and operating businesses around the world. It explores factors driving the success or failure of international business, with a focus on operating in foreign markets, and outlines key themes emerging globally as well as local intricacies across 77 jurisdictions.

The research for the report explores 292 different indicators relating to business complexity, to provide in-depth insight of the global and local challenges that impact on the ease of doing business across the world.

This year’s analysis has revealed three global trends that impact upon business complexity, the first of which we examine in more detail here: the impact of Environmental, Social and Governance (ESG) criteria on corporate behaviour and in government legislation and guidance.

The rise of environmental, social and governance (ESG)

Globally ESG is becoming more of a focus for business. However, despite the increase in interest, legal enforcement of ESG practices is not yet in place for around half of jurisdictions. This is especially the case outside the EU. ESG regulations have already been handed down to EU member states. For those that do not have legal enforcement of ESG regulations, most jurisdictions’ governments offer guidance to corporations, especially large ones, which they are expected to follow and use as guidelines.

Regulatory convergence and the alignment of standards are going to dictate the pace of the ESG evolution for the coming months and years.

There is currently a lack of international alignment, meaning the application and impact of ESG is difficult to measure and compare, particularly when it comes to complexity. Although ESG is on the rise globally, jurisdictions such as France, alongside the EU as a region, have been leading the way for many years, whereas in the Americas ESG regulatory uptake has generally been slower with jurisdictions such as Colombia only recently introducing legislation.

EU ESG regulations

Sustainable Finance Disclosure Regulation (SFDR)

SFDR requires financial market participants (FMPs) to categorise their investment funds managed or marketed in the EU. The regulation came into force across the EU in March 2021 and its aim is to encourage disclosure.

EU taxonomy

This recently applied directive aims to classify investment activities that are sustainable. It provides companies, investors, and policymakers with appropriate definitions for economic activities to be considered environmentally sustainable. It should help investors avoid greenwashing, allowing companies to become more.

Outside the EU, countries have taken similar steps to define their own sustainable finance framework. Canada and Australia have set up taskforces to deliver proposals to define regulations at national level and are coordinating their work with the EU through the International Platform for Sustainable Finance. Australia has made a sustainable finance taxonomy a priority in 2022.

A major driver of ESG practices and sentiment is the demand from companies, consumers and private investors for more ethical and sustainable ways of doing business, rather than an enforced legal drive by governments.

In jurisdictions where there is no legal enforcement of ESG practices, stakeholders are driving expectation for companies to have these policies in place.

For China, the situation is more advanced as their taxonomy was already in use prior to the EU defining their own. Towards the end of last year, the two taxonomies were laid out for comparison to identify commonalities and the main differences. The aim was to develop a ‘common ground taxonomy’, increasing interoperability of taxonomies around the world and aiding investors.

ESG is increasingly on the radar of the state, with the focus on state owned and public companies

Environmental

What we see is that most of these [ESG] trends are driven by suppliers, by investors, by the corporate world. And less so by governments themselves.

ESG is definitely a hot topic. How much of it gets instituted is yet to be seen.

Typically, environmental legislation target large corporations, and sectors that contribute negatively to the environment, such the those exploiting natural resources. However, more companies, regardless of size or industry, are now expected to have sustainability on their agenda. Given the rise in environmental consciousness, the expectation for companies to think ‘green’ is firmly on the agenda.

As with broader ESG regulations, the adoption of green legislation is not mandatory in all regions, though in the EU is it compulsory for large companies and financial market participants. At a jurisdictional or country level, some consider themselves a leader in the environmental sustainability space, whereas others refer to legislation that governments are only starting to adopt.

Guernsey and Jersey are two of the jurisdictions leading on environmental sustainability in the funds space. The Guernsey Green Fund Initiative sets out guidance for fund sponsors and limited partners (LPs) in structuring a legitimate green fund. In Jersey, the authorities have introduced ESG-related legislation for funds and fund service providers, to combat the risk of ‘greenwashing’.

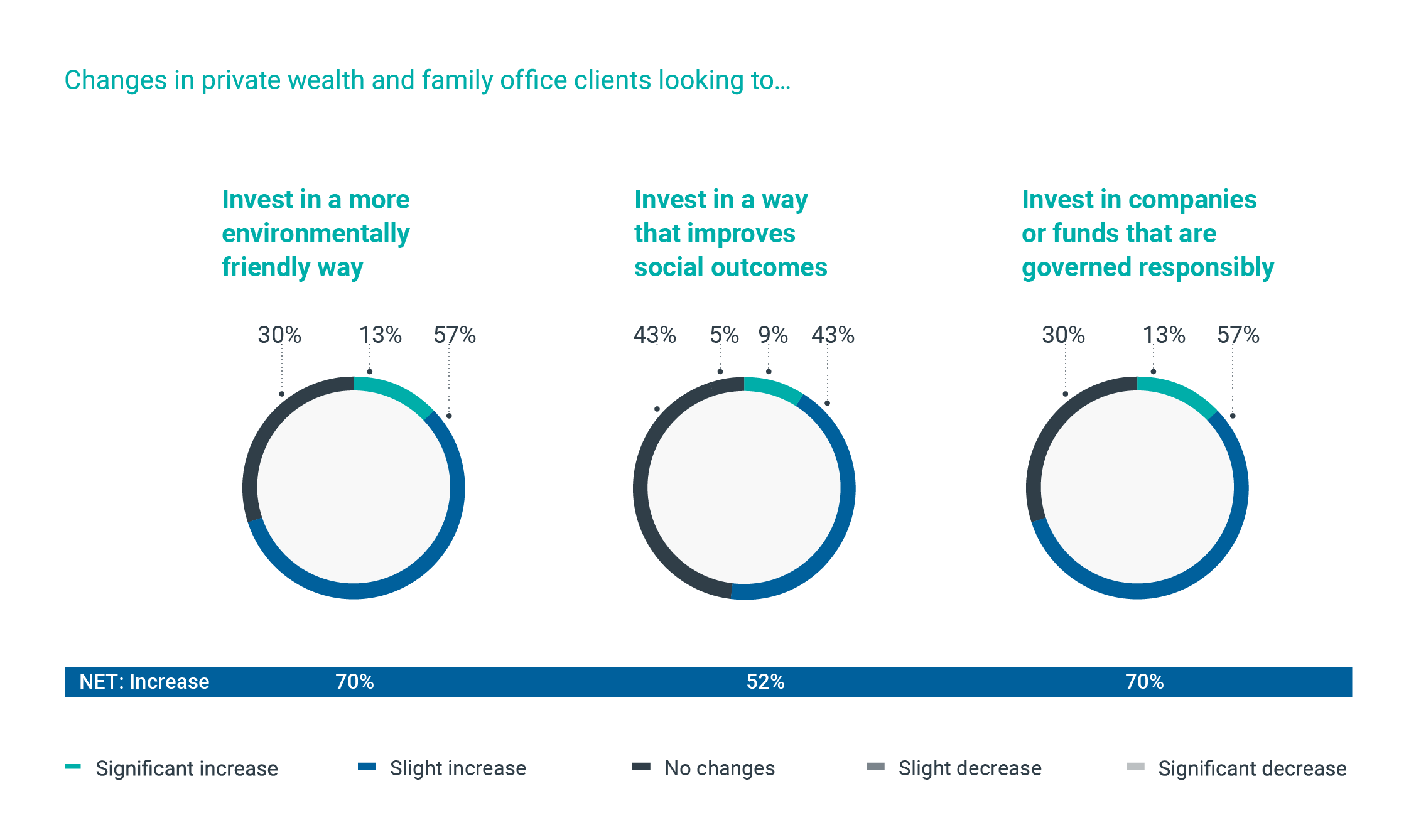

Private wealth and family office services are increasingly taking environmental practices into consideration. Clients have been increasingly investing in environmentally friendly practices over the past year in 70% of jurisdictions.

In Indonesia, ESG legislation requires that all publicly listed companies and those under the supervision of the Indonesian Financial Services (OJK) submit an annual sustainability report. Such requirements can add to complexity for those starting out on their ESG journey.

Some governments are also at an early stage of their engagement with ESG, with many only just adopting environmental initiatives and guidelines. In December 2021, for example, Colombia introduced a law for the creation of life areas and forests, while Turkey’s government introduced a recycling packaging law as recently as September 2021.

This transition will certainly lead to renewed business opportunities

At a global level, environmental legislation is being enforced at a relatively slow rate. In the case of accounting and tax, governments are less keen to enforce green and sustainability taxes, as they do not have a large impact on government revenue, so will choose to tackle other taxes as a priority.

We see an increase in the introduction of green sustainability taxes, but it's not something that advances very fast. Probably because of all the other challenges that we are talking about, such as Covid-19 and the need to raise corporate income tax rates and VAT. With green taxes or sustainability taxes, the impact upon the government revenue is not that big. Therefore, since the authorities need money to fund their government spend, it's more likely that they are going to focus on the big-ticket taxes.

A lack of international alignment on environmental legislation and reporting means additional layers of sustainability reporting at a jurisdictional level can add complexity and challenges for companies looking to do business across borders.

Social

As we’ve seen with sustainability initiatives, there is an increasing global focus on socially minded regulations that aim to support and protect employees.

Certain HR-related benefits that companies are legally required to offer have increased compared to previous years. For example, health insurance (58%), childcare assistance (31%) and housing/social care contributions (27%) are all more likely to be legally required in 2022.

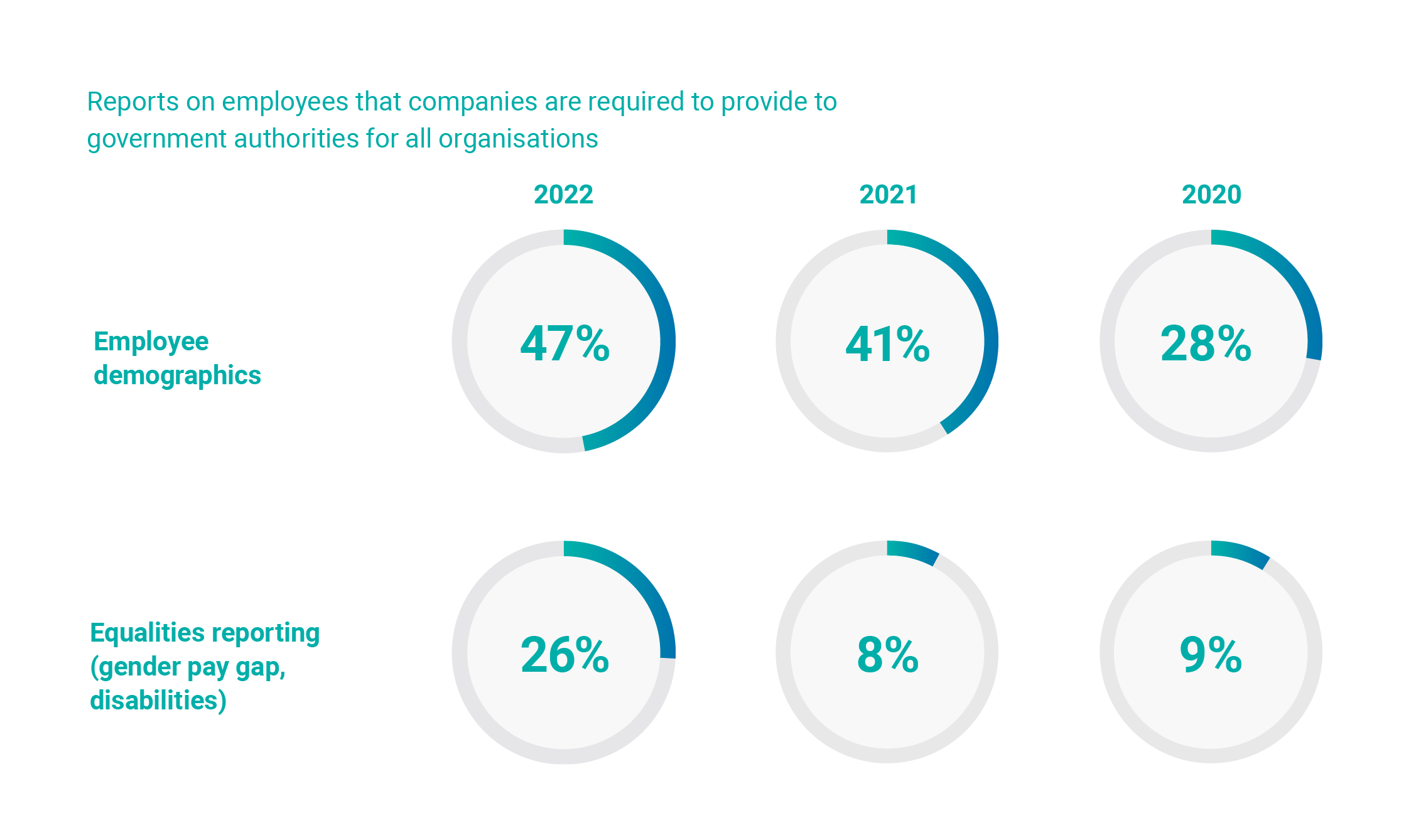

Companies are also required to submit reports and information related to equality, covering areas such as gender pay gap and disabilities, in more jurisdictions – up to 26% in 2022 from 9% in 2020.

The requirement to submit employee demographic reports to government authorities has also increased year-on-year, from 28% in 2020 to 47% in 2022. In terms of the frequency of submissions, half of jurisdictions (51%) state that employee demographic reports are submitted at least once every three months, while 36% indicate the same cadence for gender pay gap reports.

The upward trend in employee statutory reporting and data gathering was discussed by TMF Group payroll and HR experts Adele Ewing and Gary Wright:

On the HR side, people want more information about people's circumstances, eg disability, hours they work, gender pay gap reporting. All of this has really ramped up over the last five years or so. Also, a lot of countries also want to understand the compound differences between the salaries of the chief executive and the lowest paid person in the organisation. So, we're having to produce a lot more data.

These reports are growing in importance and relevance, but they add to the complexity of doing business in a jurisdiction.

As with ESG, some locations are considered ‘leading’ jurisdictions in the social space. In France, for example, there is mandatory reporting based on diversity, disability and the gender pay gap. Disability reporting is required for companies with as few as 20 employees, with gender pay gap reporting obligatory for those with 50 or more employees (50 is also the minimum in Portugal).

For the gender balance, there's a yearly mandatory report and if it's not filled, you're going to have fines. So, it's pretty easy to track.

In Croatia quotas have been set for employing people with disabilities. An employer that does not comply is obliged to calculate and pay a monthly fee – 30% of the minimum wage for each person with disabilities they were obliged to employ to meet the quota.

Other jurisdictions have recently adopted employment legislation to address diversity and inclusion. In Colombia, the government introduced the first law of its kind in December 2021, with companies receiving incentives to hire young people or women.

Governance

The final element of ESG covers corporate governance. There has been a trend for greater corporate responsibility and transparency, especially for larger organisations, and even state-owned companies.

In the case of providing Ultimate Beneficial Owner (UBO) and/or person with significant control (PSC) information to a central register, there is an increasing requirement to maintain this information at the company’s registered address, rising from 48% in 2020 to 55% in 2022. The requirement to make UBO/PSC information accessible to the general public has also risen, from 24% in 2020 to 29% in 2022.

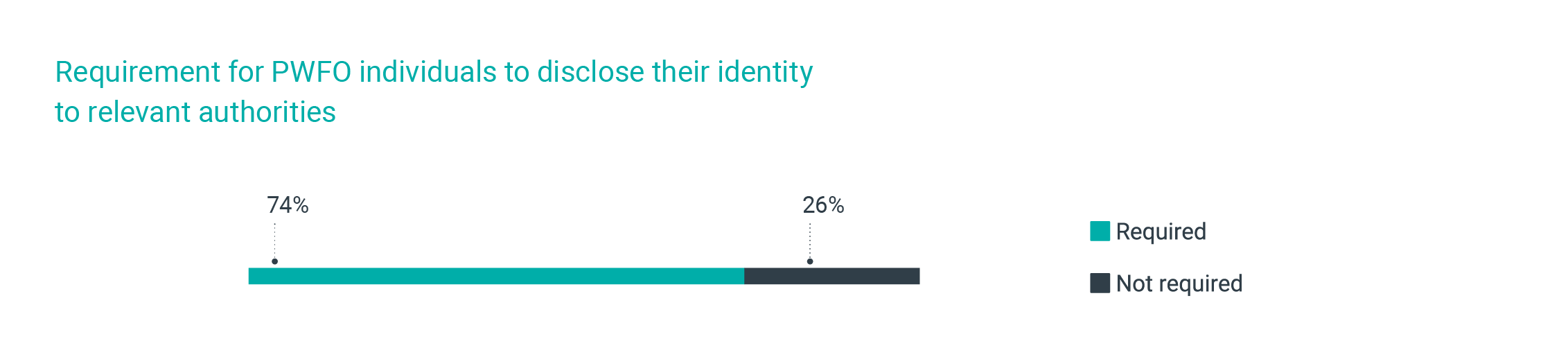

Furthermore, three quarters (74%) of popular private wealth and family office (PWFO) jurisdictions require individuals holding private wealth there to disclose their identity to relevant authorities. Transparency for investors is a global trend, but for some investors maintaining a level of privacy is important. For wealthy individuals from South American jurisdictions, investing in jurisdictions such as Curaçao and the BVI can help them to protect their assets and safety. Such individuals could be at risk if criminals and gang members in their own jurisdictions were made aware of and had potential access to their wealth.

Being close to South America, and with the constant political unrest in certain jurisdictions, South Americans want to make sure that their assets are safe. So, they will put them in offshore entities. Not to avoid tax, but just to make sure that they cannot be taken away by the government. Also, they are putting their assets here so that local banks cannot share information with criminals, so it's really also about safety.

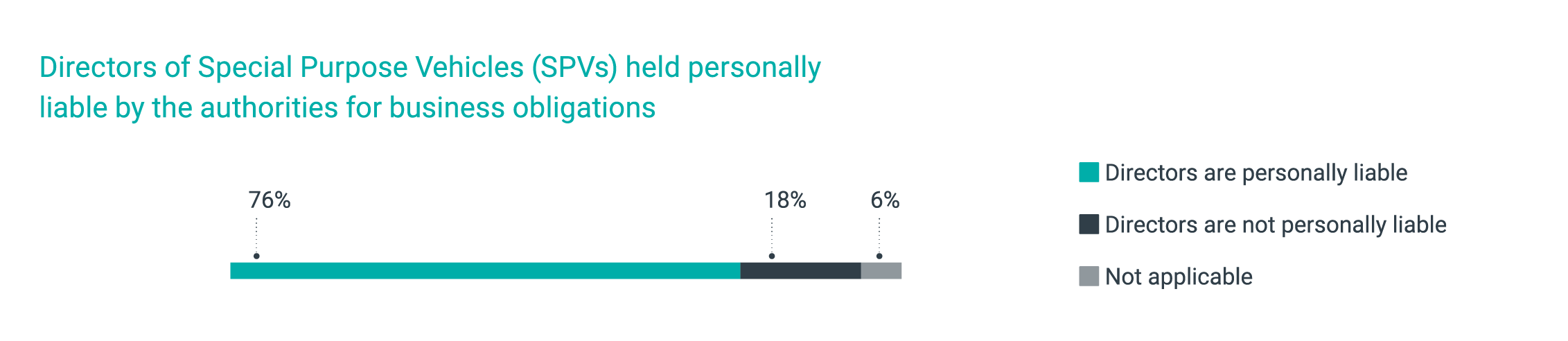

Three quarters of jurisdictions (76%) report that directors of Special Purpose Vehicles (SPVs) can be held personally liable for business obligations, linking to a focus on transparency and a focus on adherence to local laws and legislation.

This year’s research highlights transparency requirements for publicly listed companies are also on the rise. For example, since 2020 in the Philippines publicly listed companies are required to submit a manual on corporate governance. This focuses on governance responsibilities, disclosure and transparency, internal controls and risk management, relationships with shareholders and duties to stakeholders.

In Brazil companies are increasingly talking about their focus on good practice and transparency:

Brazil has a recent history coming from corruption and confrontation, which has propelled a lot of positive reactions from relevant market players towards ESG. We see companies publicising their good practices and we see good results.

We have seen, and will continue to see, an increase in the kind of legislation currently being introduced in Europe, covering areas such as whistleblowing, anti-corruption and good governance. Not only is there an increase in this type of legislation, but there is an upward trend of this type of transparency to be expected by external clients and investors.

Firms are becoming much more interested in who they're doing business with and making sure they're affiliating themselves with firms that have similar values and ethics, and ethos around how we treat people, how we treat the environment, and making sure that we have high standards for ourselves as part of the global community. Our clients typically report straight to the board on who they deal with, who they interact with, and they want to make sure that who they're doing business with has similar values and expectations.

How will ESG impact complexity?

It may be too early to say how this increased focus on ESG will impact businesses. However, ESG reporting requirements will increase complexity. Companies will have to implement ways of monitoring elements such as their carbon footprint, employee demographics, and who they invest in and with.

I think ESG will make things more complex. If you're looking at the bigger clients who will have to give ESG reporting, it's new metrics that they haven't necessarily gathered together before.

However, if ESG practices align on a global level, as they have done for EU jurisdictions, ESG reporting could be a uniform step forward for everyone, having a minimal impact on complexity.

I think the more that ESG becomes part of our standard approach to business and building our business relationships, the more we standardise it, the easier it will become. So, in that sense, I would say it could actually make things easier for us. The other side of the coin is that the more we integrate ESG, it's another hoop to jump through and another level of due diligence to add to our processes. I think it could go both ways, but I do tend to err on the side that it could actually help to simplify as we standardise.

With consumers, investors, and companies expecting organisations to have ESG practices in place, a change of culture is likely to take place globally. A step towards international alignment on ESG could mean that the impact on complexity is minimal, given all jurisdictions will have a similar experience.

We are at the crux, and the way forward is going to lead to a renewed analysis of ESG risk across products and entities - not only within the financial industry but across all others too.

The Global Business Complexity Index

The GBCI 2022 provides an authoritative overview of the complexity of establishing and operating businesses around the world. It explores factors driving the success or failure of international business, with a focus on operating in foreign markets, and outlines key themes emerging globally as well as local intricacies across 77 jurisdictions.

Explore the GBCI rankings, analysis and global trends to help you find your path to growth, amid the complexity of corporate compliance.

To download and read the report in full, visit the Global Business Complexity Hub today.

To find out more about the drivers of business complexity in the jurisdictions that matter to you, why not explore our Complexity Insights Dashboard?