GBCI 2023: Geopolitical and economic turbulence

In the first of three themes explored in TMF Group’s Global Business Complexity Index 2023 (GBCI), we look at the impact that global economic factors such as inflation, employee attrition and the war in Ukraine are having on business. We also examine how geopolitical challenges are affecting the expansion and growth plans of companies around the world.

Confidence in future economic stability has dropped since 2020

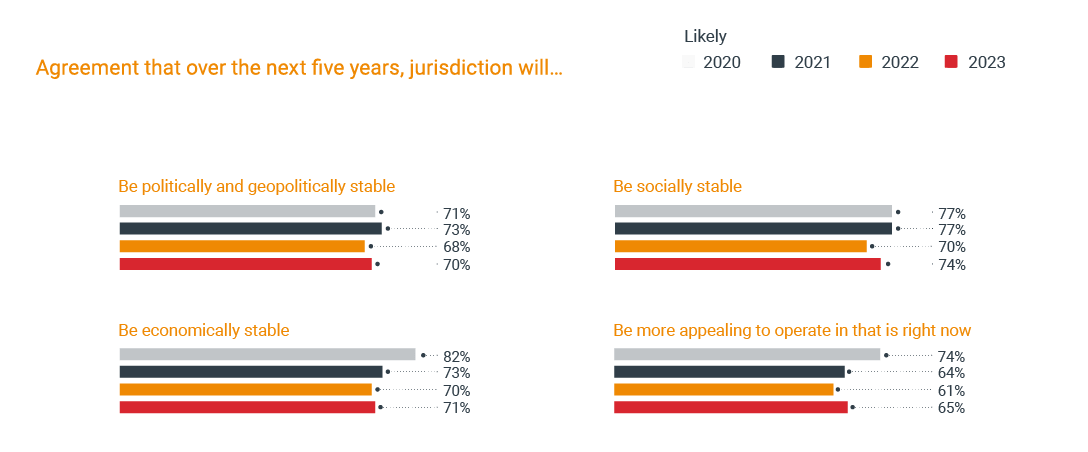

Since 2020, confidence in the economic stability of jurisdictions over the next five years has been waning. Political, geopolitical and social stability predictions have, however, remained mostly stable. This is surprising given recent global events, such as the Covid-19 pandemic, war in Ukraine and unprecedented rates of inflation around the world.

Currently, Ukraine is one of the more complex locations to do business for safety reasons, as a result of military action effective 24 February 2022.

Despite political, geopolitical and social expectations remaining stable, there is a sense that businesses may be less open to global expansion than in previous years. In 2020, 74% of those jurisdictions surveyed reported that businesses would find it more appealing to operate there over the next five years. This has dropped to 65% in 2023, suggesting that optimism has faded somewhat, and organisations may be taking a more cautious approach over the coming years.

Inflation is having significant impact globally

Economic stability is where jurisdictions have observed the greatest drop in confidence. In 2020, 82% of jurisdictions were confident about their future economic stability – this figure has dropped to 71% in 2023. Inflation is widespread and is pointed to as a factor causing significant issues. While it is impacting different jurisdictions in distinct ways, there is no doubt that the effects of the current inflationary pressures are likely to be felt for some time to come.

For example, in Vietnam where strong post-pandemic economic recovery was recorded in 2022, with GDP at 8.02%; growth is currently forecasted at 6.5%, so lower for 2023. This is due to an expected weakened global demand in major export markets, likely resulting from geopolitical tensions. It’s the same story in other APAC jurisdictions, such as Thailand, with global headwinds slowing growth, despite faster than expected recovery following Covid-19.

In South America, only 40% of jurisdictions have confidence in their economic future. Inflation has been a longstanding problem in the region, so global economic turbulence is resulting in even greater pressure in the region. For instance, in Venezuela has suffered hyperinflation over a number of years, while inflation in Argentina recently reached 95%.

Venezuela has experienced hyperinflation in recent years. The devaluation of the currency has caused five or six zeros to be taken off the currency.

Employees are placing pressure on organisations

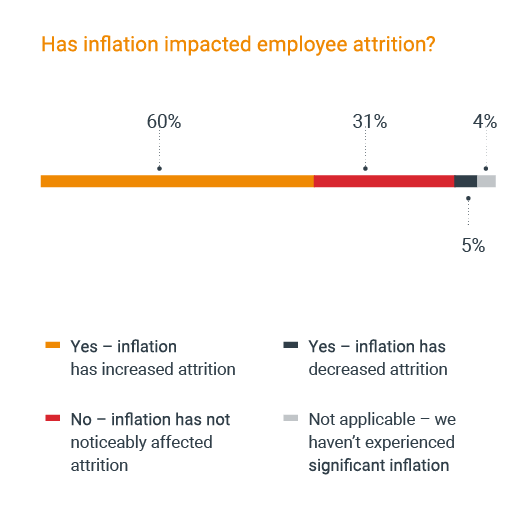

With inflation creating huge price increases on essentials like food, fuel and utilities, employees are seeking more and more financial support from their employer to make ends meet. This has led to widespread salary demand increases, and workers seeking better opportunities elsewhere. 60% of jurisdictions report that inflation has increased employee attrition. This is often combined with skills shortages to create recruitment and retention challenges for businesses. The ‘great resignation’ is putting pressure on organisations to remain agile and competitive.

The great resignation could be felt by all businesses in Italy. Most companies felt the pressure and had to spend big money to retain talent and compensate for increased attrition.

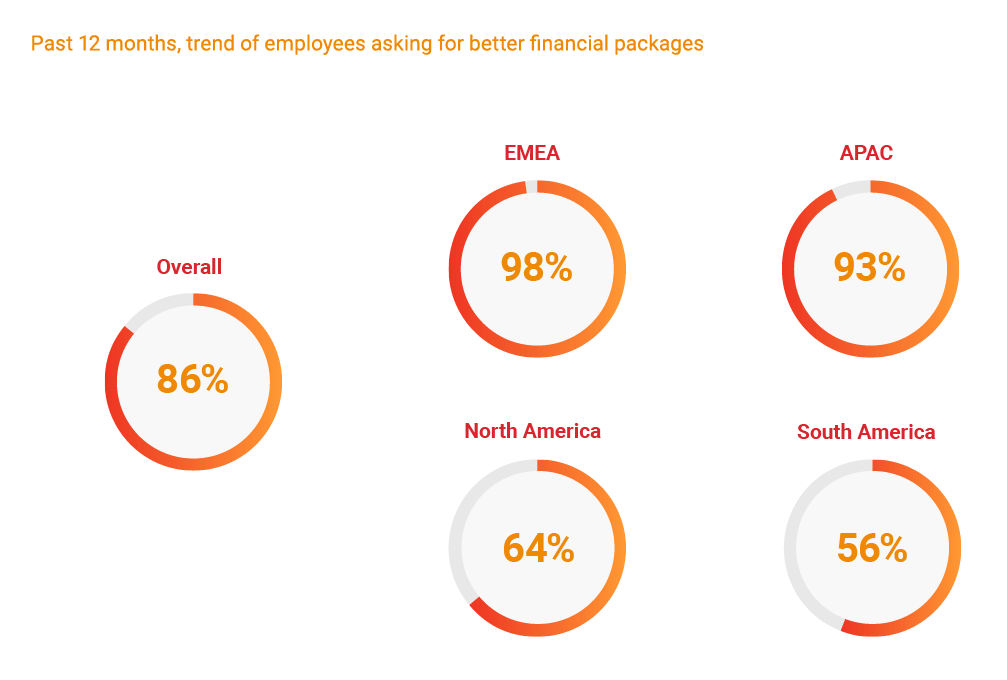

Employees are asking for better financial packages in 86% of jurisdictions. This is particularly the case in EMEA where almost all (98%) of jurisdictions surveyed are noting this trend. Changes to salaries can drive administrative complexity for organisations. In Argentina, for instance, inflationary pressure means that salaries are sometimes being increased several times per year. Every time this happens, businesses need to make relevant changes, such as updating payroll and modifying contracts, creating an ongoing administrative and cost burden.

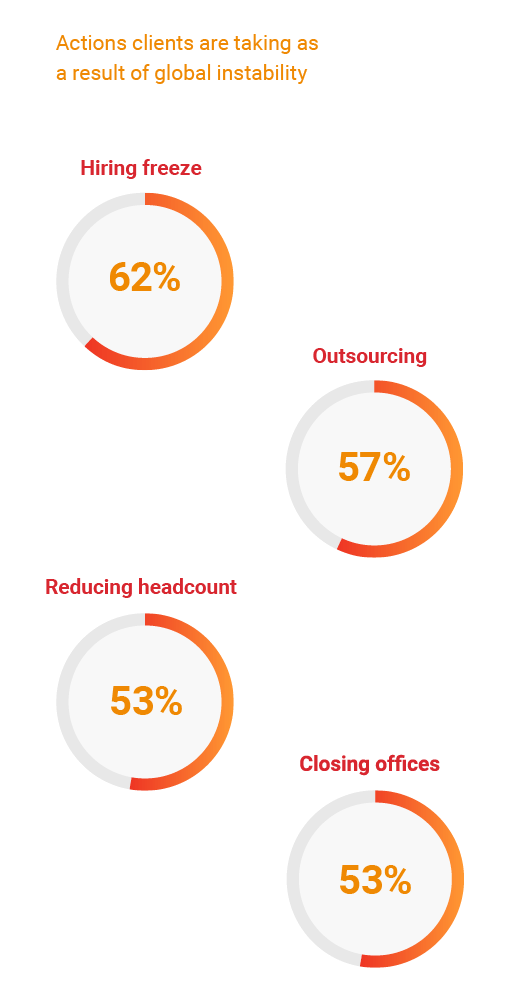

Businesses are taking action due to economic factors in a majority of jurisdictions

As global inflation impacts economic growth worldwide and causes employees to demand better financial support, it’s unsurprising that businesses are taking action to meet demands and recoup lost income. Measures like hiring freezes, outsourcing, reducing headcount and closing offices are being taken in many jurisdictions. Although such actions can work to support businesses that are struggling financially, they also create complexity for businesses to navigate. The processes of redundancy and business dissolution can be incredibly cumbersome and bureaucratic, particularly in jurisdictions with strong commitments to employee rights such as France, with its strict employment laws a key factor in making it the most complex jurisdiction in this year’s GBCI.

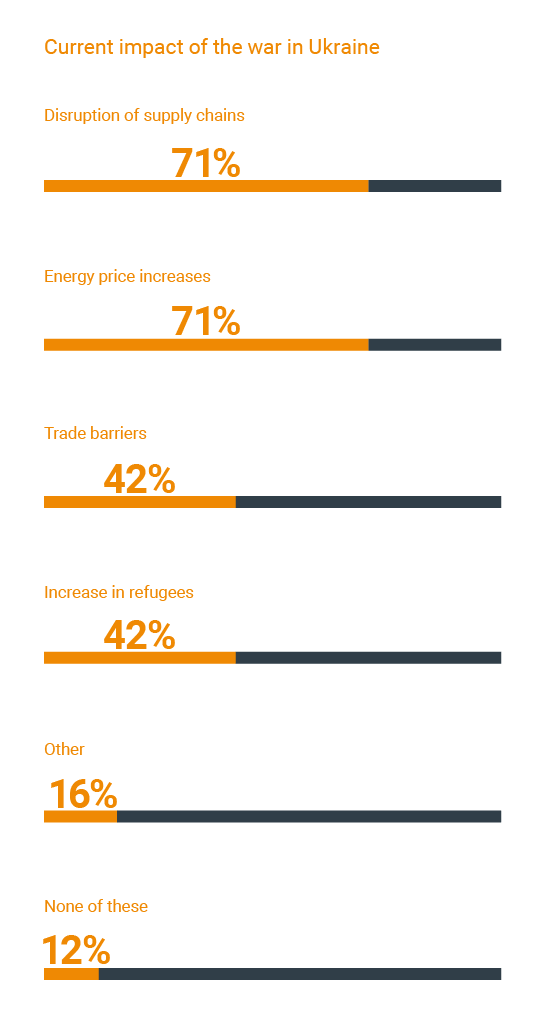

War in Ukraine affecting expansion and growth plans

Since the start of the war in Ukraine, jurisdictions have observed disrupted supply chains and increased energy prices, as well as barriers to international trade. This drives complexity and makes doing business more challenging, particularly across borders.

Such challenges hit harder for those in the shadow of the conflict. For instance, EMEA jurisdictions like Sweden have experienced increased energy prices, which in turn have caused longer lead time for some goods to be delivered. This increases production times, meaning that business operation becomes slower, more cumbersome and more costly.

Many jurisdictions that were reliant on Russia and Ukraine for exports like grain and oil are severely impacted. For instance, in Germany, the fall in imported goods has been a key driver of inflation. In Colombia, this was also the case at the start of the conflict – grain imports were affected, which increased inflation, demonstrating that the impacts of the war are global, not limited to Europe.

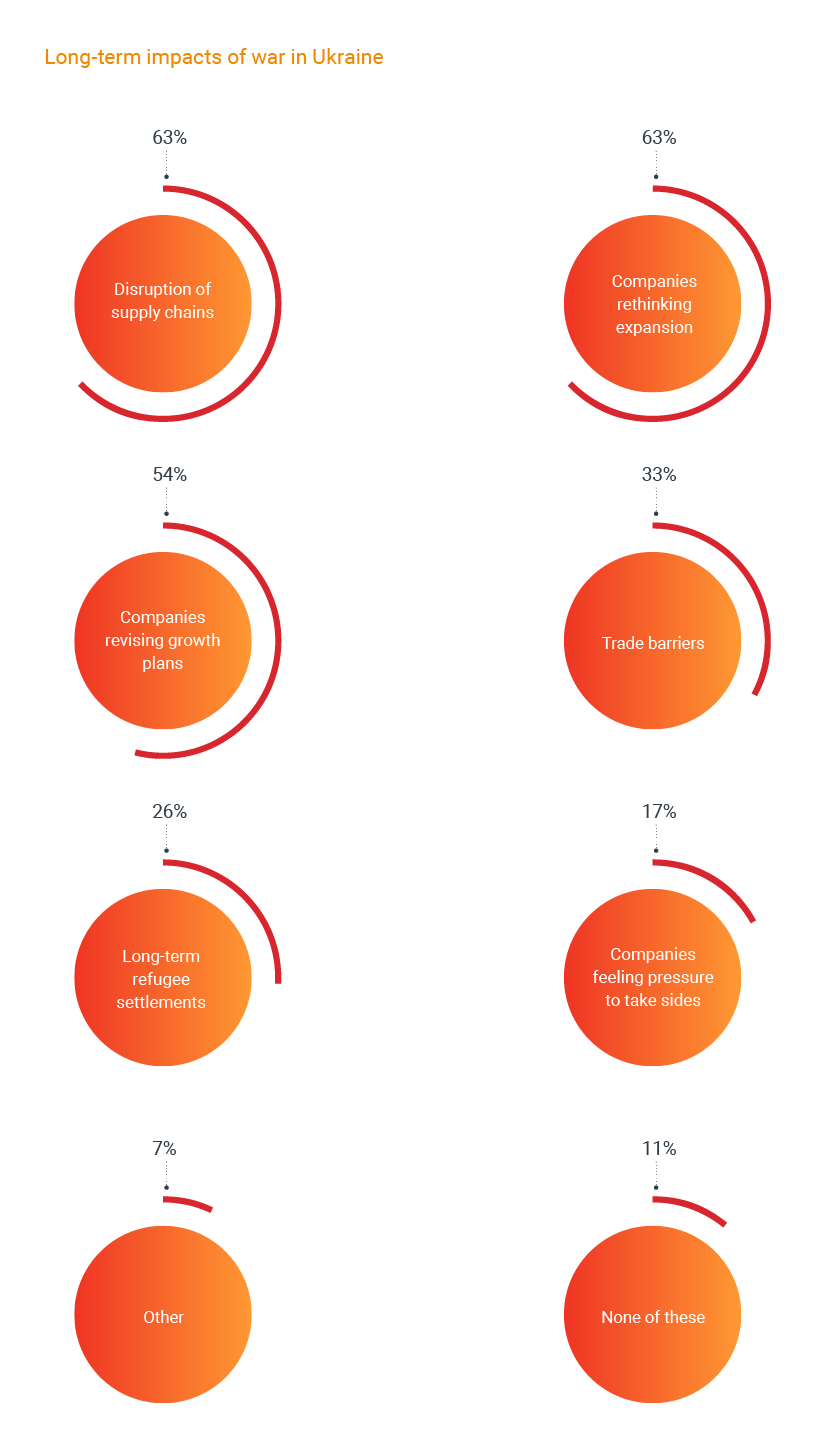

Issues resulting from the war in Ukraine are anticipated to continue, with the majority (63%) of jurisdictions predicting ongoing supply chain disruptions. It is having a clear impact on global business, with over half of jurisdictions noting that organisations will rethink their growth and expansion plans. Jurisdictions will need to work harder than ever to attract new investment and rebuild shaky economies.

However, some jurisdictions are finding opportunities to attract foreign direct investment (FDI). In the USA, for example, FDI has increased compared to pre-pandemic levels. In a time of such uncertainty, jurisdictions that can offer investors relative stability and security can be more attractive than ever.

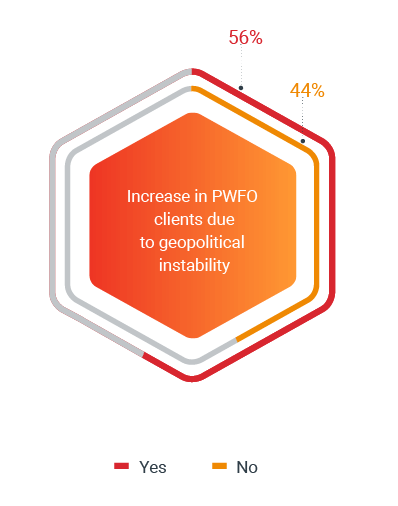

This is not only the case for businesses, but also for private investors. Over half of jurisdictions (56%) that offer private wealth and family office services, predict a trend of an increase in high net worth individuals seeking a safe place to invest their wealth due to geopolitical instability.

While the global business environment may feel more unstable than in recent years, times of hardship can often serve to create new opportunities for investment and expansion. For example, in Argentina the shortage of oil worldwide is encouraging greater self-sufficiency and focus on future export plans. it is hoped this will bolster the economy and aid recovery from the effects of unprecedentedly high inflation.

Although organisations may feel nervous about expanding, some jurisdictions are using this time to find a more prominent space in the global market, opening new doors for business. It’s also likely that governments will work harder to drive attractiveness and entice investment, meaning that businesses may find that processes and procedures are simplified in the coming years.

The Global Business Complexity Index 2023

This article is an extract from TMF Group’s latest report: The Global Business Complexity Index 2023.

Explore the GBCI rankings, analysis and global trends, to help you cut through the layers of corporate compliance complexity – download the report in full here.

To find out more about the drivers of business complexity in the jurisdictions that matter to you, why not explore our Complexity Insights Dashboard?