GBCI 2024: Multinational risk and how it shapes the business environment

With geopolitical instability on the rise, organisations must navigate factors such as supply chain disruption, trade barriers and high energy prices that affect business complexity. In the second of three themes explored in TMF Group’s Global Business Complexity Index 2024 (GBCI), we will examine the measures that businesses are taking to offset these challenges, including outsourcing and rethinking expansion plans.

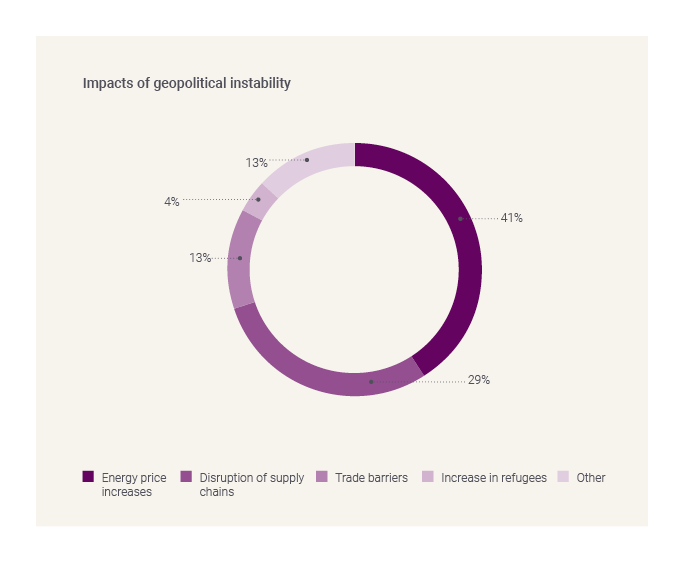

Energy price increases have been highlighted as the most pivotal impact of geopolitical instability, with many jurisdictions revising potential growth plans and expansion goals as a result. Outsourcing is on the rise, with many jurisdictions also utilising regional integration as a means of accessing new markets.

Energy price increases are viewed as the biggest fallout from geopolitical instability

These results are largely driven by EMEA and the bottom 10 jurisdictions, where over half highlight energy price increases as the largest impact of geopolitical instability. In contrast, APAC, South America and the top 10 jurisdictions felt more impact from disruption of supply chains at 54%, 50% and 33% respectively.

Unsurprisingly, the war in Ukraine, the Red Sea blockage and declining relations between the US and China's Mainland were all identified as key geopolitical issues causing severe disruptions to global supply chains.

For example, jurisdictions that rely on Ukraine for agricultural exports must now find alternatives at less competitive prices, whilst the Red Sea blockage is causing severe delays to the provision of chemicals. In a similar vein, worsening relations between the US and China's Mainland were identified as causing supply chain disruptions, due to increased trade barriers and in some places, sanctions. Jurisdictions are finding themselves needing to align with one of the two blocs and thus, halting trade with the alternative side accordingly.

The main geopolitical issue is the struggle between the US and China's Mainland, where Australia has taken a stance with the US. This has caused trade tensions with China's Mainland, who are imposing restrictions on certain Australian exports. Inflation across wages, oil prices and real estate in Australia has affected businesses adversely, leading to hiring freezes.

However, supply chain disruption has not necessarily negatively impacted all jurisdictions – for some, it is an opportunity to take market share from previously successful players.

For instance, the war in Ukraine has meant that wheat exports from Russia and Ukraine have seen a dramatic reduction. As a result, many jurisdictions are looking elsewhere for a supplier of agricultural produce. Not only has this provided an opportunity for Argentina to boost its exports, less wheat in circulation also means it has been able to increase its export price. TMF Group experts in Argentina highlighted that while this as a key area for growth for the country, it is not without its challenges. Strict export quotas are imposed by the government to ensure there is enough grain supplied internally. This will limit how much the country can grow its exports to meet demand. The cost of fertilizer has also risen due to the conflict in Ukraine. This is having considerable profitability implications for farmers in Argentina, who require more fertilizer to meet increased demand. This is a good example of where supply chain disruption can positively impact a developing jurisdiction, as long as its systems are set-up to respond flexibly.

Similarly, Vietnam is benefitting from the China Plus One Policy, where jurisdictions are looking for more cost-effective manufacturing hubs outside of China's Mainland.

Spotlight: Connector economies

Polarisation is taking place across the world, with declining US and Chinese relations at the heart of this new shift. Global trade flows are rapidly changing and, as a result, we are seeing the emergence of new connector economies, which play a neutral role between the US and Chinese power blocs. As relations between the US and China's Mainland continue to decline, two trends are occurring; both the lengthening and the shifting of the supply chain.

Bloomberg identified five key players in this process – Mexico, Vietnam, Indonesia, Poland and Morocco.1 According to Bloomberg Economics, these countries combined accrued $4 trillion in economic output in 2022, surpassing India and approaching Germany and Japan.2

Whilst these may not be the only players benefitting from shifting global trade, these jurisdictions are geographically and strategically well-positioned to continue to be an important link in US-China's Mainland trade.

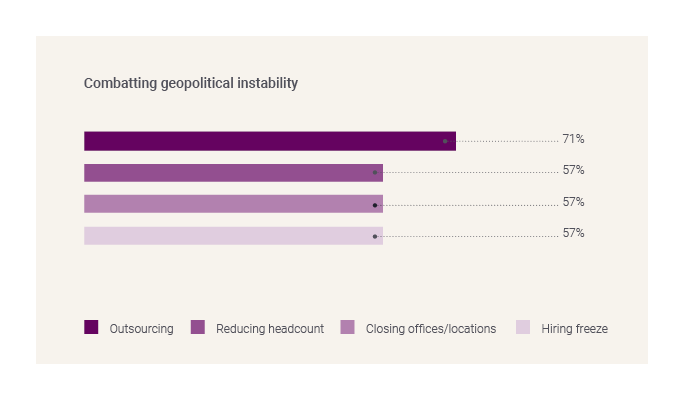

To combat geopolitical instability, jurisdictions are opting to outsource

TMF Group experts across the globe have highlighted the challenges of hiring in the current market climate. An expensive and shrinking talent pool is resulting in higher recruitment and hiring costs, which has led many jurisdictions to outsource.

Almost all regions – with the exception of North America – are outsourcing at a high proportion. APAC jurisdictions are outsourcing at a higher rate of 86%, compared to just 42% of North America. Outsourcing enables businesses to approach economic challenges with high degrees of flexibility, bringing in expertise for short-term contracts only when required. The high-level of outsourcing is also consistent across both the top and bottom ten jurisdictions, at 78% and 75% respectively.

I think if clients relied on the human resources, that would be too risky because as we all know, the talent in Hong Kong, SAR is very expensive. This year, our talent pool has also become smaller because more people are looking to migrate.

Instead of outsourcing to combat instability, North America adopts a variety of strategies which include the closure of offices/locations, headcount reduction and hiring freezes. High proportions of South America (80%) also opt for headcount reduction, with this strategy strongly linked to a jurisdiction’s labour laws. Where countries are more easily able to let employees go and in doing so create a leaner workforce, it can be an easier method of off-setting instability.

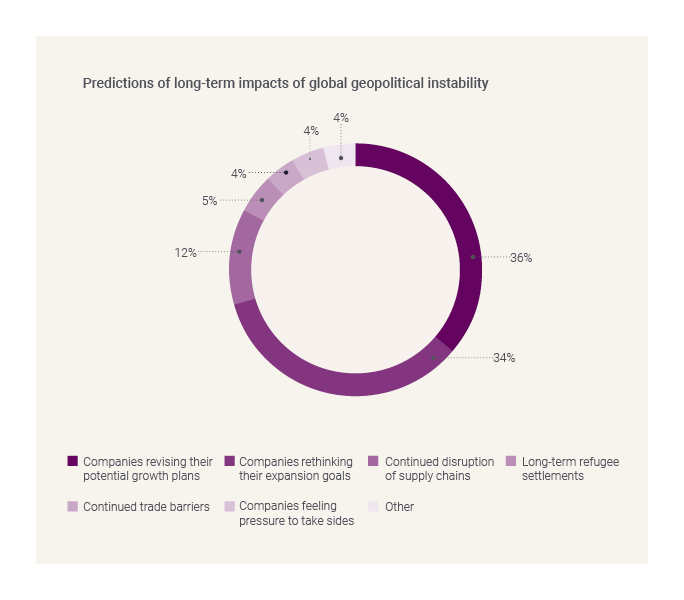

Jurisdictions are revising potential growth plans and expansion goals due to geopolitical instability

Worldwide geopolitical instability is predicted to have a longer-term impact on growth (36%) and expansion goals (34%) for organisations operating globally. For jurisdictions in North America, this increases to nearly half (46%) of jurisdictions revising their potential growth plans and half of jurisdictions (50%) in South America rethinking their expansion goals.

In comparison, whilst supply chains in the short-term are being disrupted, jurisdictions are confident this will stabilise somewhat in the long run, with only 12% predicting continued disruption. This points to a confidence in the ability of the global market to adapt and identify opportunities elsewhere.

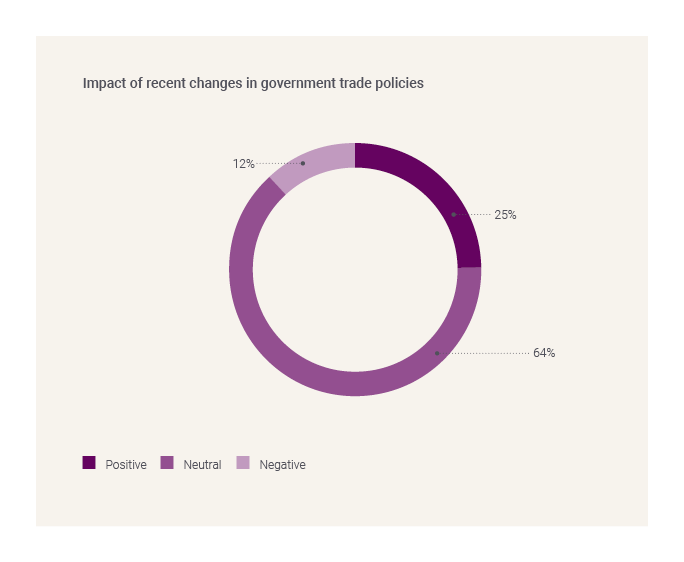

Outside of the APAC region, many jurisdictions see recent changes in trade policies as having had no impact

Overall, 64% of jurisdictions see recent changes in trade policies as having had no impact on level of trade. In contrast, 43% of jurisdictions in the APAC region and 30% of top ten jurisdictions view impacts to have been more positive. TMF Group experts operating both in APAC and more complex jurisdictions spoke of numerous trade policies created to cement close liaison within the region.

Indonesia and Malaysia, both bridge countries and complex jurisdictions, are examples of this. In Malaysia, the government has implemented the New Industrial Master Plan and the National Trade Blueprint, both attempts to boost export capacity with key players in the region. Likewise, the Global Entity Management section of the GBCI report outlines the role of the Omnibus Law in Indonesia.

In contrast, none of the bottom ten jurisdictions perceived a positive impact of recent changes in government trade policies, with a third citing a negative impact. Some TMF Group experts, namely Australia and the UK, suggested this was the result of aforementioned geopolitical tensions, with jurisdictions limiting or stopping trade with certain jurisdictions, or having high tariffs imposed against them.

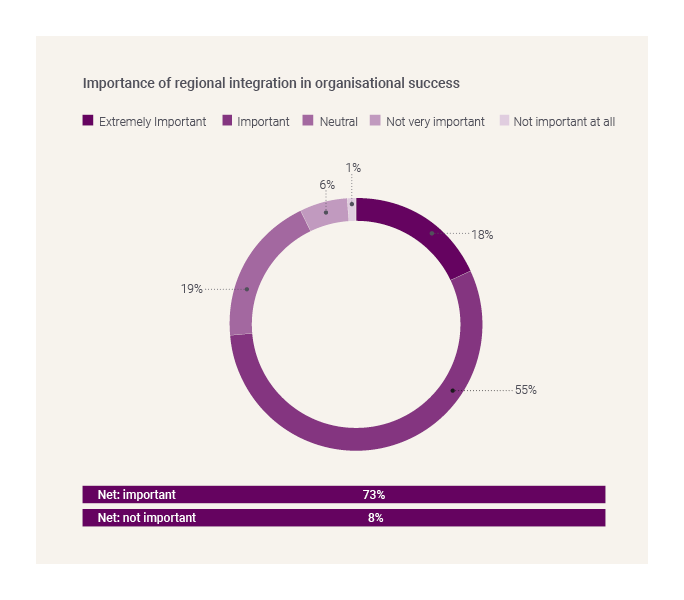

The majority of jurisdictions recognise the importance of regional integration

Three quarters of jurisdictions (73%) acknowledge the importance of regional integration in organisational success. North American and APAC jurisdictions particularly recognise the benefit of regional integration at 86%, which then drops to 50% for South America. South American jurisdictions also have the highest proportion of jurisdictions who view regional integration as unimportant, at 20% compared to 8% overall.

TMF Group experts located in APAC – namely Singapore, Hong Kong, SAR, Vietnam, Malaysia and Indonesia – noted that integration can be a beneficial way to create a frictionless flow of trade, capital and intellectual property. Creating trade policies or improving economic cooperation can not only improve market efficiency, but also lead to faster regional growth.

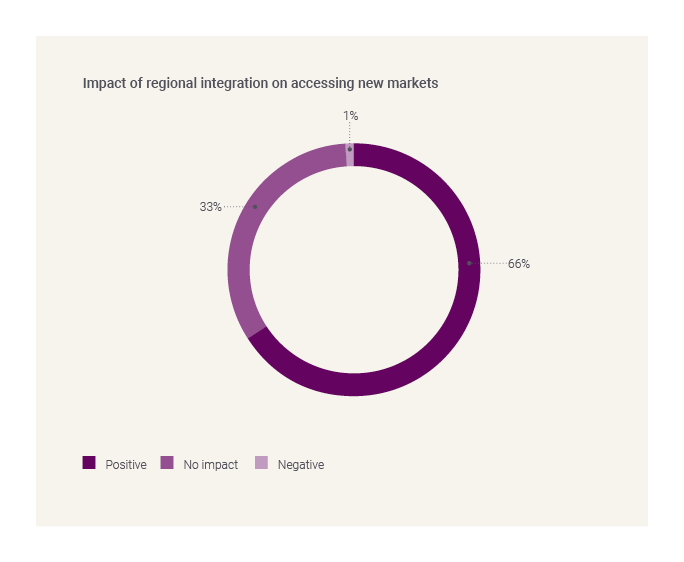

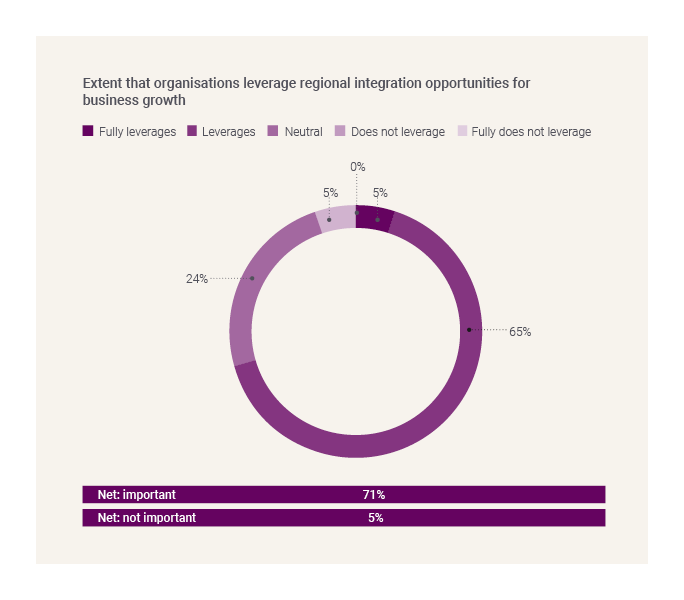

Jurisdictions utilise regional integration as a way to access new markets and for business growth

A large majority (71%) of jurisdictions leverage regional integration for business growth (71%) and use it as a tool for accessing new markets (66%). Only 1% of jurisdictions report a negative impact of regional integration. Regional integration is most commonly leveraged in South America (89%) and APAC (79%), and commonly adopted in APAC (86%) to access new markets. As mentioned previously in this report, some bridge economies – namely Indonesia and Vietnam – are tangible examples of jurisdictions that benefit from regional integration as a means of accessing new markets.

The Global Business Complexity Index 2024

This article is an extract from TMF Group’s latest report: The Global Business Complexity Index 2024.

Explore the GBCI rankings, complexity indicators and global trends to help you cut through the layers of compliance complexity in over 70 jurisdictions – download the report in full here.

To find out more about the drivers of business complexity in the jurisdictions that matter to you, explore our Complexity Insights Dashboard where you can analyse up to three markets at one time.

2 Ibid