Private wealth and family offices – navigating complexity in a changing landscape

Managing family wealth continues to be an increasingly complex business. Options available to families continue to increase, as does the number of personal factors to consider. We examine how the trends highlighted by this year’s Global Business Complexity Index are impacting those managing family wealth and associated offices.

As we emerge from a global pandemic it is clear that the drive for simplicity is continuing, while there’s increasing demand for, and adoption of, Environmental, Social and Governance (ESG) good practice.

Private clients and family offices are concerned with reputation, compliance, governance, legal and political stability, access to specialists and, importantly ,how to navigate complexity of the global markets they operate and invest in. While tax continues to be a consideration, it is no longer the overriding factor it once was.

The changing priorities of private wealth clients

TMF Group’s Global Business Complexity Index 2022 (GBCI) report provides an authoritative overview of the complexity of establishing and operating businesses around the world. The GBCI 2022 is based on 292 different indicators relating to business complexity, and results in an in-depth analysis of the global and local challenges that impact on the ease of doing business across the world.

We have observed an increasing global drive towards transparency affecting the perceived complexity of some locations. While the GBCI recorded changes at a corporate governance level, we’ve witnessed similar trends at an individual level among our private wealth and family office clients.

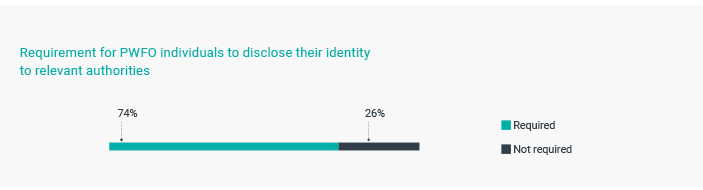

Three quarters of popular private wealth and family office jurisdictions require individuals holding private wealth there to disclose their identity to relevant authorities. Transparency for investors is a global trend, but for some, maintaining a level of privacy is equally important.

The decision of where to locate a family office and establish an effective wealth management structure may simply come down to something more practical such as time zone, language capabilities and access to specialist advice and talent. However, political, social and economic stability remains at the forefront of decision making for our clients. Geopolitical tension between China and the US, and the Russian invasion of Ukraine, have increased the climate of uncertainty. This has led to an increasing number of local experts predicting instability over the next five years.

Jurisdictions where laws and regulation are clear and not open to interpretation tend to be simpler, often because the government actively seeks to help businesses and investors adhere to the regulations they put in place. Singapore is an example of where the government has gone to great lengths to establish itself as a leading wealth management centre, with sound regulation and strong rule of law.

Striving for responsible wealth management

The next generation of private wealth clients are increasingly focusing on more responsible management of their wealth. This may include socially responsible investment, paying what is considered a fair rate of tax, ensuring good corporate governance, or increased philanthropy. It is also true that more companies, regardless of their size, are now expected to have sustainability on their agenda.

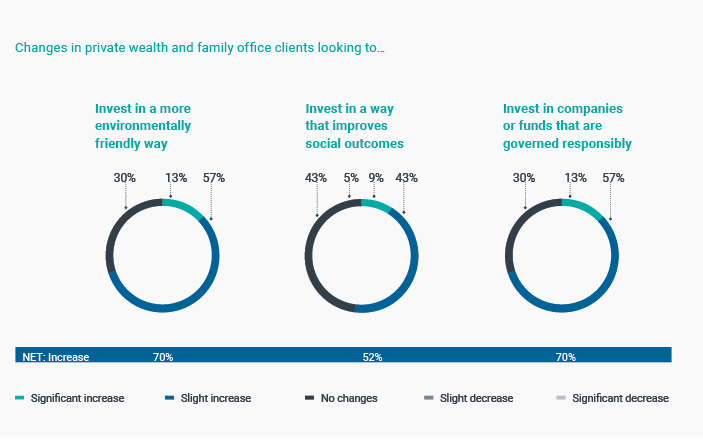

This rising trend has clearly prompted some clients to consider the wider impact of how and where to manage their wealth. Research from the 2022 GBCI indicates private wealth and family office clients have increased investment into more environmentally friendly practices in 70% of jurisdictions over the past year.

However, we have observed that when clients compare jurisdictions, they realise the complexity involved and that the ‘gap’ between the transparency and good governance offered in offshore and onshore jurisdictions is, to a large extent, more a perception than a reality.

As the trend for ESG grows, it is likely to ignite a change of culture on a global scale and increase complexity in jurisdictions where there are currently fewer requirements. By contrast, if these practices are aligned on a global level, as has been done in EU jurisdictions, ESG reporting could be a uniform step for everyone and will subsequently have a minimal impact on complexity.

A major driver of ESG practices and sentiments comes from a demand from companies, consumers and private investors seeking ethical and sustainable ways of doing business, rather than an enforced legal drive by governments. This is not a new trend in the Private Wealth and Family Office arena as many have been, and continue to be, at the forefront of setting the agenda.

Changing investment landscapes

Alongside the changing priorities of private clients, we’ve observed a levelling of the playing field across some jurisdictions. Contributing to this effect are the moves by some governments to encourage wealthy families to relocate or return to their country of origin. Portugal, Italy and Israel are examples of countries where changes have been made to that end.

On the other hand, while some less developed nations offer a highly attractive investment option, clients have historically been discouraged from investing due to the complexity of complying with the local rules and regulations.

The impact of Covid-19

The Covid-19 pandemic has accelerated many of the trends which were already in play, in turn encouraging clients to take a look at their investment strategy. For some, this has led to a drive towards more philanthropic investing. Other clients have faced cashflow challenges, leading to the consolidation of their structures and businesses.

In the post-pandemic era, increased inflation levels and social and political stability are more of a consideration in some jurisdictions than before. Where governments made the decision during the pandemic to provide additional support to businesses and individuals, we are now observing that the effect of injecting money into the economy has in turn boosted inflation.

Covid-19 has highlighted the need to manage costs more effectively and simplify asset management, and this has necessitated the introduction of efficiency or cost savings for many clients. For some, this will mean that outsourcing services such as payroll, accounting and administration is a more cost-effective option. TMF Group can support clients with their outsourcing needs. We will help reduce administration costs and provide a single point of contact to keep the process simple.

An increasingly technological and digitalised world

Private wealth and family office businesses have become increasingly reliant on technology platforms. This is as much an outcome of the Covid-19 pandemic – which limited the ability for face-to-face interaction - as it is a change which was already in the background, and it is one which is unlikely to be reversed. As the business world moves towards greater working flexibility, technology continues to be the enabler of this change. But this change doesn’t come without challenges.

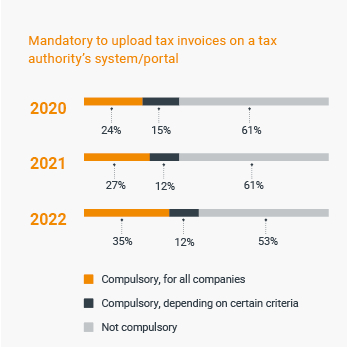

New digital reporting requirements can create challenges for organisations as they work to update existing processes or take on new ones. Globally, the compulsory uploading of tax invoices electronically via the authority’s system or portal is increasing. In 2020, it was compulsory in only 24% of jurisdictions for all companies to do this, this figure has now risen to 35% in 2022.

Family businesses are following this trend and becoming increasingly keen to utilise technology. This may involve using digital platforms to evaluate asset performance or increasing the efficiency of reporting. However, although technology drives down the cost of delivery, private wealth and family office clients will always require a personal relationship to ensure that their specific objectives are achieved. While technology enables greater flexibility and efficiencies, it must be implemented effectively to ensure maximum productivity.

The future of the offshore world

While offshore centres may receive negative commentary in some quarters, in others they are seen as playing an important role in generating and protecting wealth, ensuring the efficient deployment of capital across global markets.

Offshore jurisdictions have by design been less complex and offered a greater level of privacy and tax neutrality than their onshore equivalent. This year those kinds of jurisdictions make up 50% of the ten least complex jurisdictions for doing business. In fact those five – Jersey, BVI, Hong Kong, Curacao and the Cayman Islands – feature in the top six out of a total of 77 jurisdictions.

The drive towards transparency has meant that some of the perceived benefits of holding assets in traditional offshore locations may no longer exist. Yet we predict that the offshore world will continue to remain robust and attractive to private wealth and family office clients. As the world becomes more transparent, these jurisdictions will continue to provide specialist services and compliant environments for our clients to manage their wealth.

An example of this is an increased requirement for digitalisation. In some of the jurisdictions which we have observed to be the simplest, we cannot ignore they also have a longstanding commitment to digitalisation. This includes Denmark, Curacao and the BVI. However, Covid-19 has enabled more complex jurisdictions, such as Jersey, to catch up in their digitalisation journey and reduce the need for face-to-face interaction between businesses and government bodies, making doing business significantly easier.

The decision-making criteria for private wealth clients are changing, and client circumstances may dictate a bias towards a particular location – which may or may not be a traditionally simple one.

Book in a health check today

Many clients today have sought the expertise of TMF Group specialists to help them navigate the many complexities highlighted in the GBCI. With our assistance, private wealth clients and family offices can overcome such hurdles and benefit from the advantages offered by these jurisdictions.

Every client is different. TMF Group experts are here to discuss with you your individual circumstances and personal aims. Working with you in a close partnership, we’ll explore a range of suitable jurisdictions for structuring your investments.

Our business offers you a platform which gives you access to the specialised knowledge of local experts in 85 jurisdictions around the world. Together we can make an informed decision on which locations will be most appropriate in helping you to achieve your goals and guiding you through the complexities which may exist.

Latest publications

Our global services

Expand your business efficiently across borders

Get in touch to find out how we can help your organisation grow in a complex world.

Contact us Contact us