Transferring assets from one family member to another is a complex and weighty decision – especially if it involves a family business, or assets located around the world. Both personal and business succession should be planned carefully by someone you trust. TMF Group has the knowledge and experience to give you the comfort that your planning, and its execution, are properly aligned with your overall financial and succession strategy.

Taking the wider view in succession planning and wealth transfer

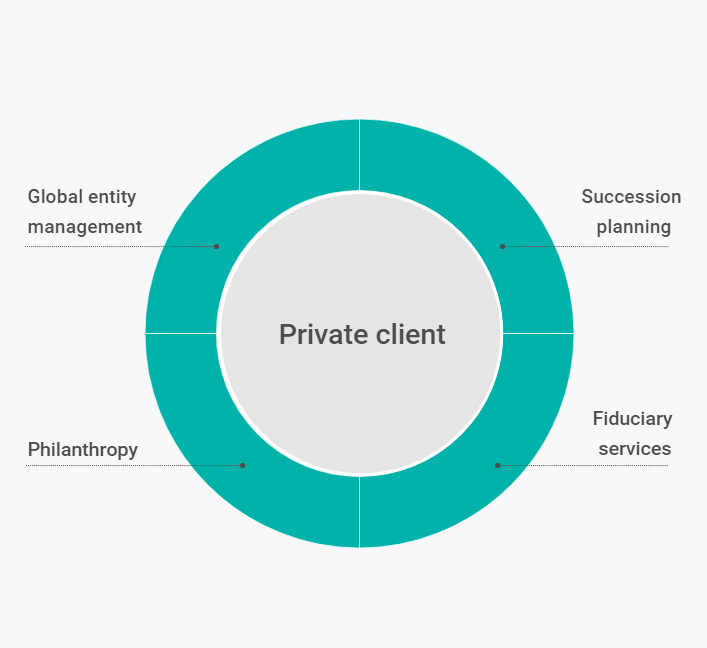

TMF Group takes the wider view of your succession planning and wealth transfer needs. We make sure everything is in line with your broad financial goals, as well as your estate and inheritance plan. Whether you want to gift assets to family members or provide support for philanthropic endeavours, we help ensure a smooth and efficient transition while taking care of any potential estate and inheritance tax complexities.

TMF Group’s private wealth and family office team helps you develop a detailed succession plan, working with your advisers to develop and administer the most appropriate solutions. Your plan must consider the tax implications of any strategy and look at the most appropriate provisions to protect personal and business assets, even after succession takes place.

We help with the establishment of trusts, foundations, and other asset-holding vehicles to facilitate succession, estate and inheritance planning. Once the preferred structure is set up, we make sure it runs smoothly. We provide trustee and other fiduciary services to manage the chosen structure in a compliant way. We can also offer company secretarial services and a registered office – while maintaining appropriate records and accounts for the structure at all times.

When it comes to legislative and regulatory obligations, we can take on the burden of filing all required returns and declarations. Our accounting package includes the preparation of financial statements, tax preparation and filing plus regulatory reporting – providing you with a complete and comprehensive service. You can rest assured that your structure, no matter how complex or simple, will always remain compliant.